NIO Inc. is a pioneering and leading firm in the world smart electric vehicle market, before we consider nio stock price prediction 2025. NIO, founded in November 2014, strives to construct a more sustainable and better future with its mission of “Blue Sky Coming”. NIO defines itself as a user-centric enterprise that combines innovative technology with exceptional experience. NIO designs, develops, manufactures, and sells smart electric vehicles, propelling innovation in next-generation core technologies. NIO distinguishes itself via continual technology breakthroughs and innovations, great goods and services, and a community focused on shared progress. NIO offers premium smart electric vehicles under the NIO brand and family-friendly smart electric vehicles under the ONVO brand.

As we look towards the future, electric vehicle (EV) stocks continues to gain momentum. Nio Inc. is one of the Top competitors in this industry, a company that has captured the attention of investors worldwide. With growing market interest, many are curious about the Nio stock price prediction for 2025. This blog post delves into expert analyses and forecasts for Nio’s stock price in 2025. It explores the factors influencing these predictions and what they might mean for investors.

Overview of Nio Inc. and Its Market Position

Nio Inc. is a leading manufacturer of new energy vehicles (NEVs) in China, where the market is experiencing a significant upswing. This growth provides Nio substantial opportunities to increase its market share in the coming years. Nio is strategically positioned to capitalize on this trend, aiming to double its vehicle deliveries by 2025 compared to its 2023 figures, targeting an ambitious delivery goal of approximately 165,000 units.

Recent Financial Performance and Stock Trends

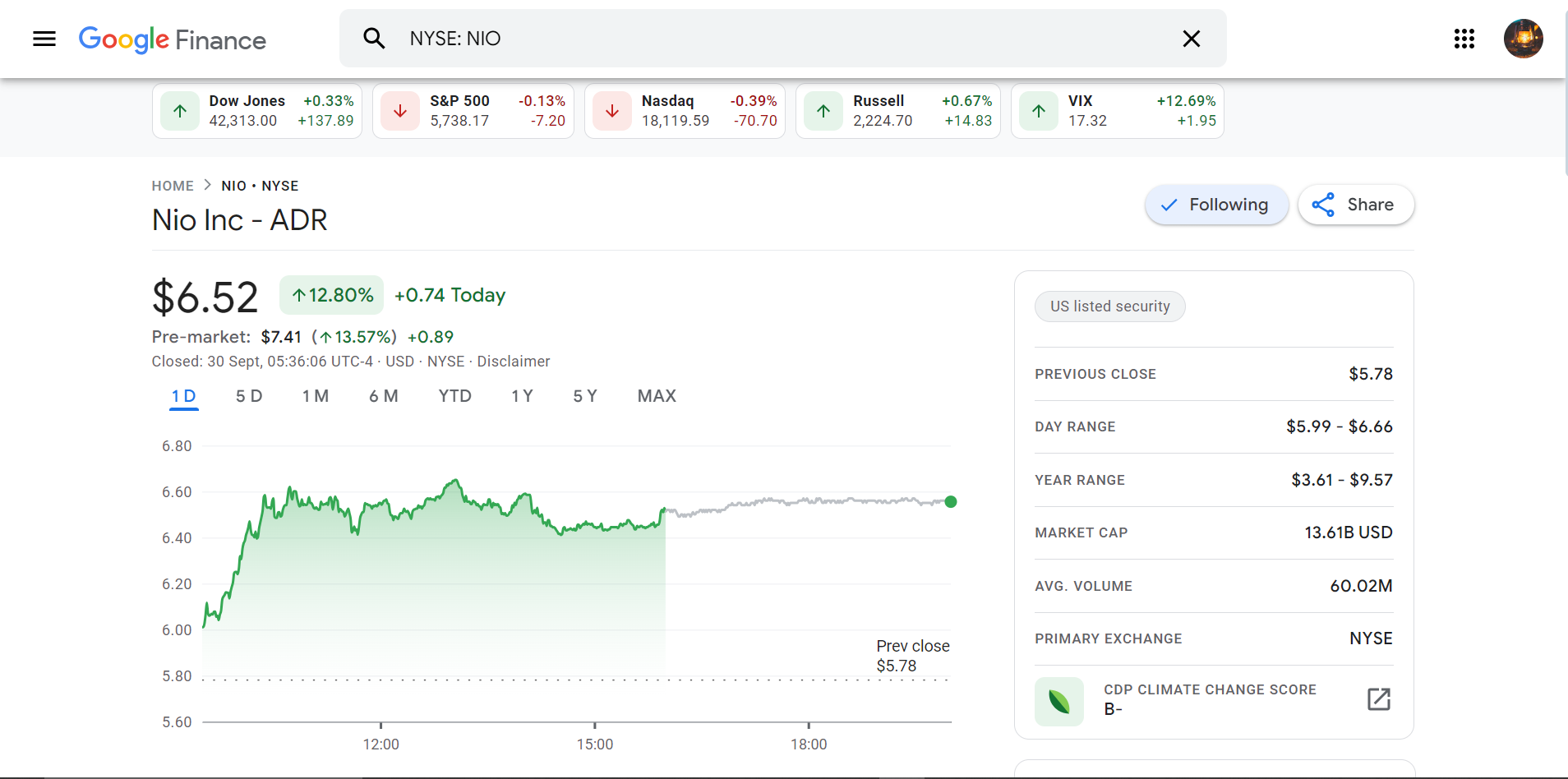

Nio’s recent financial performance has been promising, with projections indicating positive trends for its stock price. Analysts expect Nio’s stock to witness a 14.31% increase in 2025, reaching an estimated $6.63 per share. Moreover, the company’s revenue is projected to grow by 60%, amounting to 97,052 million CNY by 2025. This robust financial outlook highlights Nio’s potential for sustained growth.

Impact of Technological Innovations on Nio’s Growth

Technological advancements are crucial in Nio’s strategy for future growth and competitive advantage. A key innovation is Nio’s battery swap technology, designed to alleviate range anxiety and provide a more efficient charging solution. This technology is projected to reduce vehicle costs by 15% to 30%, positioning Nio as a cost-effective option in the EV market. Beyond battery swapping, Nio is also expanding its infrastructure significantly. The company plans to build over 4,000 battery swap stations globally by the end of 2025, underscoring its commitment to EV infrastructure development. This ambitious expansion underscores Nio’s commitment to taking charge of EV infrastructure development. Additionally, Nio is investing in autonomous driving technology and advanced driver-assistance systems (ADAS), aiming to enhance the safety and convenience of its vehicles. These technological strides are not just about keeping up with competitors but also setting new industry standards and positioning Nio as a pioneer in the EV space.

Competitive Landscape and Market Challenges

The EV market is incredibly competitive, with numerous players striving to secure their positions. Nio faces stiff competition from local and international companies, each bringing distinct advantages. With its strong global brand and technological edge, Tesla remains a formidable opponent. BYD, another Chinese giant, has a comprehensive lineup and benefits from vertical integration, making it a robust competitor. XPeng also poses a significant challenge with its focus on intelligent technology and autonomous driving features.

Continuous innovation and strategic adaptation are crucial for Nio’s success in this environment. The company’s commitment to battery swap technology and expansion of its infrastructure are strategic moves that set it apart. However, staying ahead in this fast-evolving market requires more than just technological prowess. Nio must also effectively manage supply chain challenges, which have become more pronounced due to global disruptions.

Additionally, consumer preferences and market demand can shift rapidly. While there is a growing appetite for electric vehicles, the competitive landscape means that Nio must continually enhance its value proposition to attract and retain customers. Marketing and brand perception play significant roles here, as does customer satisfaction and after-sales service.

Furthermore, geopolitical factors and trade relations can impact Nio’s market access and operational costs. For instance, tariffs and trade policies between significant economies could affect supply chains and market entry strategies.

As Nio navigates these challenges, its ability to innovate, maintain operational efficiency, and strategically expand its market reach will be critical to its success in the competitive EV industry.

Regulatory Environment and Government Policies

Government regulations and policies play an instrumental role in shaping the trajectory of the electric vehicle industry. For Nio Inc., the regulatory environment in China is particularly crucial, as it is the company’s primary market. The Chinese government has been actively promoting the adoption of new energy vehicles (NEVs) through various incentives such as subsidies, tax breaks, and relaxed licensing requirements. These policies create a favorable market environment for Nio, enabling it to scale its operations and increase its market share.

In addition to national policies, regional regulations also impact Nio’s strategy. For instance, certain Chinese cities have stringent emission norms and quotas for electric vehicle sales, pushing automakers to prioritize green technologies. These local regulations can significantly influence Nio’s production and marketing decisions, driving the company to focus on innovation and sustainability.

Globally, Nio must also navigate the regulatory landscapes of other markets it aims to penetrate. European countries, for example, have introduced rigorous emission standards and are gradually phasing out internal combustion engine vehicles. This regulatory push towards electrification aligns well with Nio’s long-term goals. It strongly incentivizes the company to expand its footprint outside China.

Moreover, safety regulations and standards are another critical area Nio must adhere to domestically and internationally. Meeting these standards ensures compliance and enhances consumer trust in Nio’s products.

Lastly, trade policies and international agreements can impact Nio’s supply chain and market access. Tariffs, import/export restrictions, and bilateral trade agreements between significant economies can influence Nio’s operational costs and strategic decisions, making it essential for the company to stay adaptable and well-informed.

Global Economic Conditions and Their Influence on Nio

Global economic conditions significantly influence Nio’s operational strategies and stock performance. Trade relations, currency fluctuations, and macroeconomic trends shape the company’s growth trajectory. For instance, favorable trade agreements can open new markets for Nio’s electric vehicles. In contrast, adverse trade policies might hinder supply chain efficiencies and increase operational costs. Currency fluctuations are another critical factor, particularly as Nio expands its presence in international markets. A potent Chinese Yuan against other currencies could impact the company’s export competitiveness. At the same time, a weaker Yuan might increase import costs for essential components.

Furthermore, global macroeconomic trends such as economic growth rates, inflation, and consumer spending patterns also affect Nio’s market prospects. In periods of robust economic growth, consumer spending on high-ticket items like electric vehicles generally increases, benefiting companies like Nio. Conversely, economic downturns or recessions can dampen consumer spending, posing challenges for maintaining sales momentum. Additionally, the global push towards sustainability and green energy adoption creates an environment ripe for growth in the EV sector. However, Nio must stay vigilant and adaptable to changes in economic conditions to sustain its growth and achieve its ambitious targets.

Analyst Predictions and Market Sentiment

Market analysts are optimistic about Nio’s prospects, forecasting a favorable outlook for its stock price. Over the next year, Nio’s stock is expected to experience a 19.66% increase, reaching around $6.94 per share. This indicates growing confidence among investors and analysts in Nio’s business model and market strategy. Looking further ahead to 2027, Nio’s stock price is projected to reach $13.80, representing a substantial 137.93% increase from current levels. These forecasts reflect the strong market sentiment and optimism surrounding Nio’s future growth.

Conclusion

Nio Inc. has demonstrated significant potential for growth as it navigates the competitive and rapidly evolving electric vehicle market. With strategic initiatives focusing on technological innovations, such as battery swap technology and advancements in autonomous driving, Nio is positioning itself as a leader in the EV sector. These technologies enhance the consumer experience and provide a competitive edge in an industry where differentiation is critical.

The company’s financial projections indicate a solid upward trajectory, with analysts forecasting a significant rise in stock prices and revenue by 2025. This optimism is rooted in Nio’s robust market strategies and ability to adapt to changing regulatory environments and economic conditions. The supportive government policies in China and global shifts toward sustainability create a fertile ground for Nio to expand its market reach.

However, Nio must remain vigilant in addressing the competitive pressures of local and international players. The presence of established giants like Tesla and rapidly growing companies like BYD and XPeng means that Nio needs to become complacent. Continuous innovation, efficient supply chain management, and a keen understanding of market dynamics will be essential for maintaining its competitive edge.

Final Thoughts Nio stock price prediction 2025

Global economic conditions also pose both opportunities and challenges for Nio. Favorable trade agreements and stable macroeconomic conditions can propel Nio’s growth, while economic downturns and currency fluctuations may present obstacles. Hence, Nio’s ability to adapt and respond to these external factors will be critical to its success.

Investor sentiment remains positive, with market analysts projecting substantial Nio’s stock price growth over the next few years. This reflects broader confidence in Nio’s strategic direction and capacity to meet ambitious targets. For investors, the combination of technological innovation, favorable financial outlook, and strong market positioning makes Nio an attractive prospect in the EV sector.

As we look toward nio stock price prediction in 2025, Nio Inc. appears is ready to capitalize on the growing demand for electric vehicles. The company’s strategic focus on innovation and market expansion positions it for sustained growth, making it a compelling option for those looking to invest in the future of transportation.