Decentralized Finance (DeFi) has emerged as a revolutionary force in cryptocurrencies, offering financial products and services outside traditional banking systems. Among the many innovations within DeFi, staking has gained significant traction. Staking enables investors to participate actively in blockchain networks, earn passive income, and contribute to network security. In this article, we will delve into DeFi staking, its benefits, risks, and potential to drive widespread crypto adoption. Decentralized Finance (DeFi) has emerged as a revolutionary force in cryptocurrencies, offering financial products and services outside traditional banking systems. Among the many innovations within DeFi, staking has gained significant traction. Staking enables investors to participate actively in blockchain networks, earn passive income, and contribute to network security. In this article, we will delve into DeFi staking, its benefits, risks, and potential to drive widespread crypto adoption.

Understanding DeFi Staking:

DeFi staking involves holding and “staking” a particular cryptocurrency in a digital wallet to support the operations of a blockchain network. By staking their tokens, individuals actively participate in network consensus mechanisms, such as Proof-of-Stake (PoS), where validators are selected to confirm transactions and secure the network. In return for their contribution, stakers earn rewards through additional tokens. These rewards incentivize investors to hold and stake their tokens, increasing network security, stability, and decentralization.

By staking Ether in Ethereum 2.0, individuals contribute to the network’s security and consensus process. Validators are selected based on the amount of Ether they have staked, and their responsibility is to propose and validate new blocks. In return for their participation, validators earn rewards in the form of additional Ether.

Staking Ether in Ethereum 2.0 offers several benefits. Firstly, stakers can earn passive income by receiving staking rewards. The more Ether staked, the higher the potential rewards. Secondly, staking helps secure the network by ensuring validators are vested in maintaining its integrity.

Ethereum 2.0’s staking mechanism also allows smaller investors to participate in network validation. Instead of requiring compelling mining hardware, staking only requires users to meet a minimum threshold of Ether to become validators.

Furthermore, Ethereum 2.0 staking promotes the long-term value of Ether by reducing its immediate supply. As more Ether is staked and locked up in the network, the circulating supply available for trading decreases, potentially leading to price stability and upward price pressure.

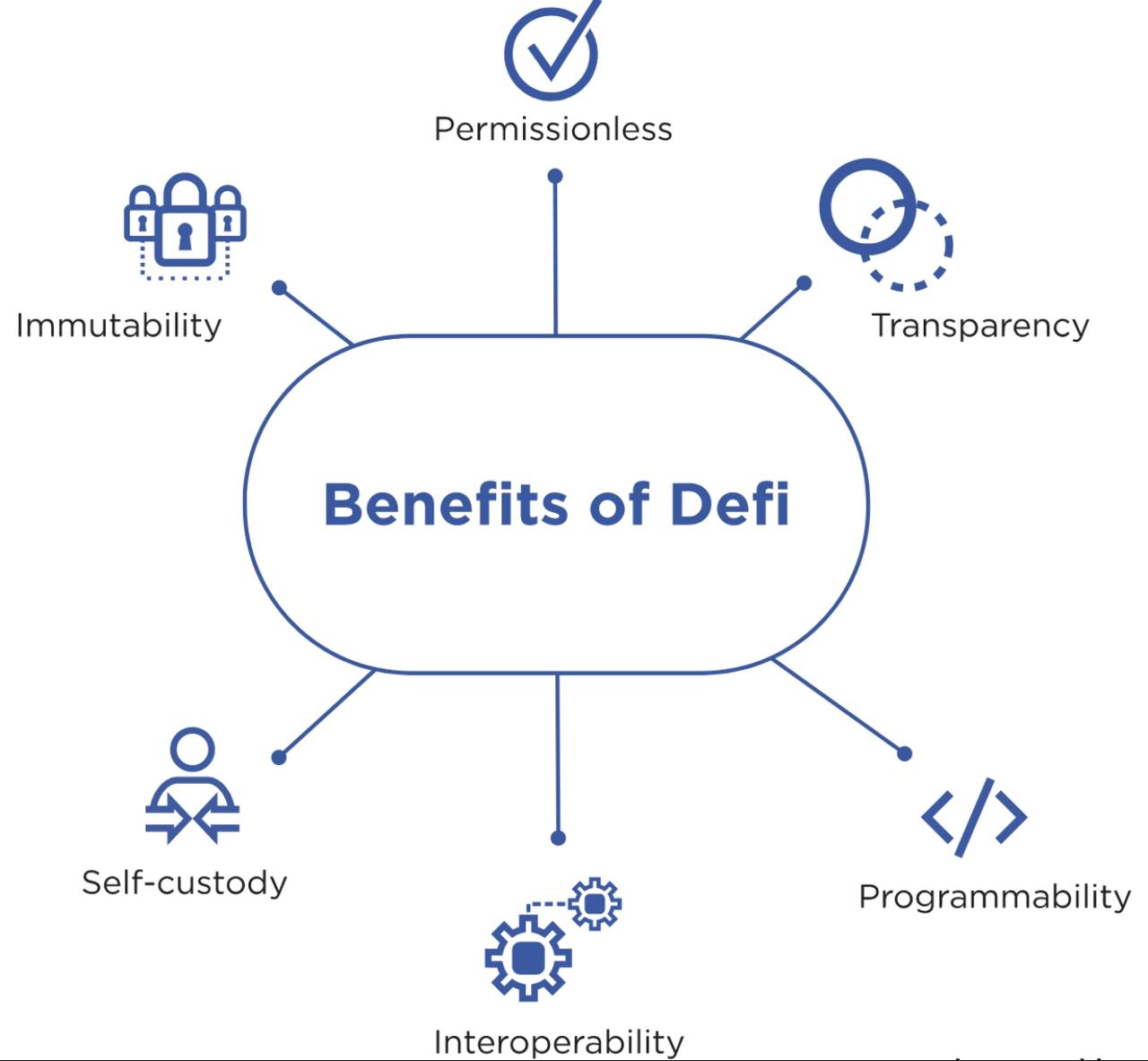

Benefits of Defi Staking:

- Passive Income: DeFi staking allows investors to earn passive income by holding and staking their tokens. Stakers are rewarded with additional tokens or cryptocurrency for securing the network and maintaining consensus.

- Higher Yields: Staking offers higher yields than traditional investment avenues such as savings accounts or bonds. This attracts investors seeking opportunities for greater returns on their digital assets.

- Price Stability: When investors stake their tokens, they lock them up for a specific period, reducing immediate liquidity. This action helps stabilize the token’s price by decreasing supply and counteracting sudden sell-offs.

- Network Security: Staking actively contributes to network security by participating in consensus mechanisms like Proof-of-Stake (PoS). Validators are selected to confirm transactions and secure the network, making it more resistant to attacks.

- Decentralization: Staking encourages decentralization by empowering token holders to participate actively in network governance and decision-making processes. This involvement reduces reliance on centralized entities and promotes a more distributed and democratic ecosystem.

- Community Engagement: Staking fosters community engagement within cryptocurrency networks. Investors become more involved in the project, contributing to discussions, voting on proposals, and shaping the network’s future development.

- Liquidity Provision: Staking locks up tokens for a specific period, reducing their immediate availability for trading. This action can contribute to increased liquidity for the network by reducing short-term speculative trading and promoting long-term investment.

- Diversification: Staking allows investors to diversify their portfolios by allocating some of their holdings to different cryptocurrencies and networks. This diversification strategy helps manage the risk and potential losses of holding a single asset.

- Accessible to All: DeFi staking is open to anyone with internet access and a digital wallet, making it accessible to individuals worldwide. It provides an opportunity for people who may need access to traditional financial services to participate in earning rewards and building wealth.

- Innovation and Adoption: Staking is driving innovation in the cryptocurrency space, attracting new users, and promoting the adoption of blockchain technology. The potential for earning rewards and participating in-network governance incentivizes individuals to explore and invest in cryptocurrencies, fostering the growth of the entire ecosystem.

Risks and Considerations:

While DeFi staking offers numerous advantages, being aware of the risks is essential. One critical risk is the potential for slashing, wherein stakers may lose some of their staked tokens if they violate network rules or fail to fulfill their validator duties. Additionally, stakers must be cautious of selecting reliable and secure staking platforms, as the decentralized nature of DeFi makes it susceptible to scams and hacks. It’s vital to conduct thorough research, evaluate the reputation and security measures of the platform, and consider the network’s overall governance structure before engaging in staking activities.

Driving Crypto Adoption:

DeFi staking plays a crucial role in driving widespread crypto adoption. By allowing investors to earn passive income on their digital assets, staking presents a compelling incentive for individuals to explore and invest in cryptocurrencies. Moreover, the stability of staking can attract risk-averse investors who were previously hesitant to participate in the volatile crypto markets.

Additionally, the potential for higher yields compared to traditional investment avenues can incentivize individuals to allocate a portion of their portfolio toward cryptocurrencies. As more people engage in staking, the overall liquidity of the network increases, enhancing the functionality and attractiveness of the blockchain ecosystem.

Furthermore, staking fosters community engagement and decentralization. It encourages token holders to actively participate in network governance, decision-making processes, and consensus mechanisms. This involvement empowers investors, strengthens the decentralization ethos of cryptocurrencies, and reduces reliance on centralized financial institutions.

Conclusion:

DeFi staking has emerged as a game-changing concept within the realm of cryptocurrencies. By offering investors the ability to earn passive income, stabilize token prices, and actively contribute to network security, staking drives widespread crypto adoption.