Decentralized finance, or defi for short, uses blockchain technology and smart contracts to develop open, transparent, and permissionless financial services. Defi applications, or dapps, allow users to borrow, trade, invest, and earn interest on their crypto assets without intermediaries or centralized control.

However, defi is also a complex and fast-growing field, with hundreds of dapps and protocols competing for users and liquidity. How can one keep track of the latest developments, trends, and opportunities in defi? How can one compare different dapps and protocols based on their performance, risk, and potential?

This is where Defi Llama comes in

What is Defi Llama?

Defi Llama is the largest defi Aggregator currently in the world. It provides up-to-date information about all known Layer 1 and Layer 2 (L1 and L2) blockchains through its ecosystem dashboard. Any interested user can get information about APY, Staking, TVL, and other project data at no cost.

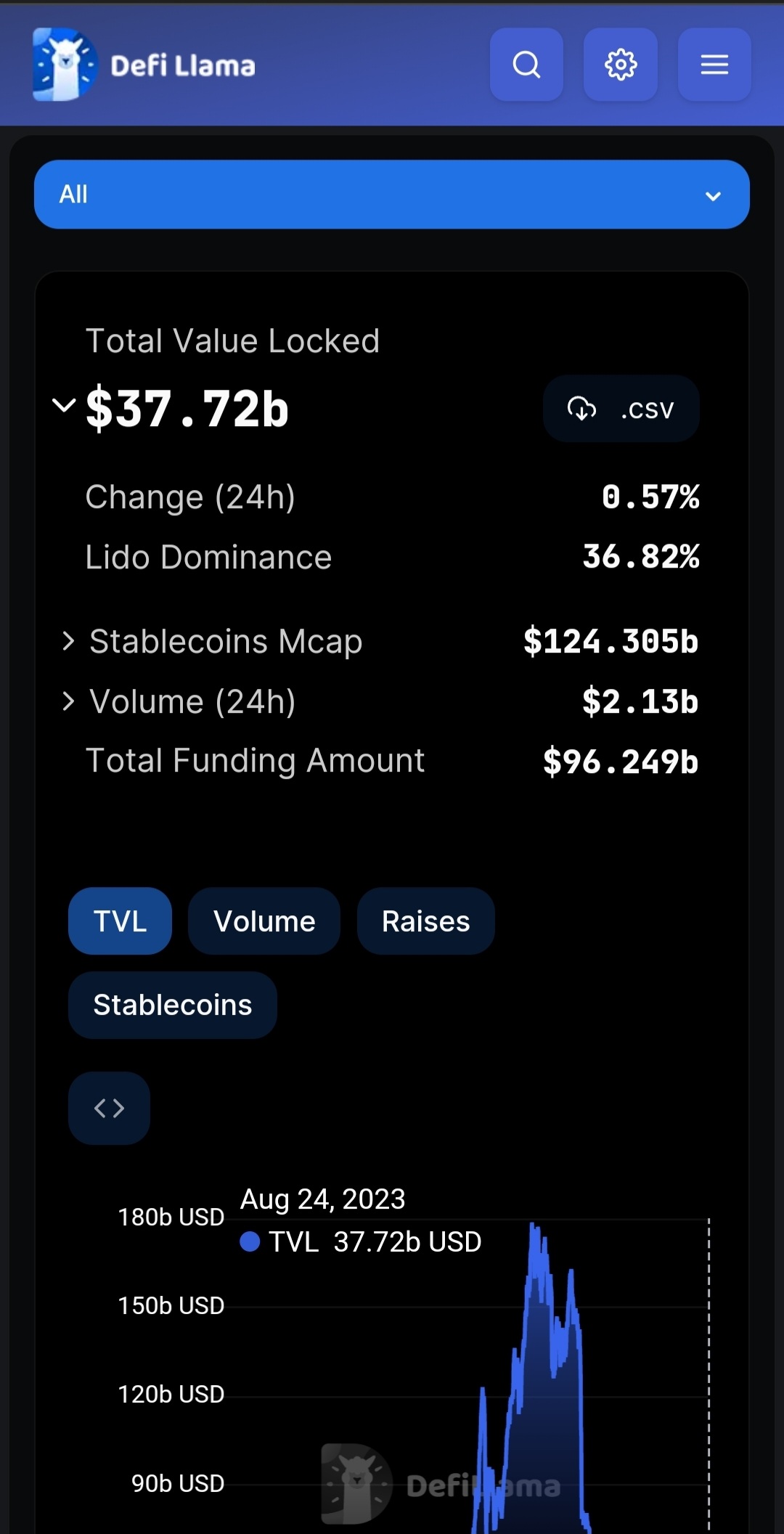

What is TVL?

TVL or total volume locked refers to the amount of funds or assets locked in a project’s protocol’s smart contract. Users usually lock their funds as part of the staking. In return, it will increase the liquidity of the token. When users lock funds, it generates profit, increasing price stability and less volatility.

TVL for the Defi’s Llama project can be viewed through the project website.

https://defillama.com/

What is Apy?

Annual Percentage Yield or APY includes all ready-return or interest on an asset, including compound interest or a return on a deposit. These returns also have interest from reinvestment and saved capital. <span;>The APY is a general indicator that enables you to evaluate yields from stacking or liquidity pools of various pairs of tokens and count predicted revenue. An annual financial gain may alter.

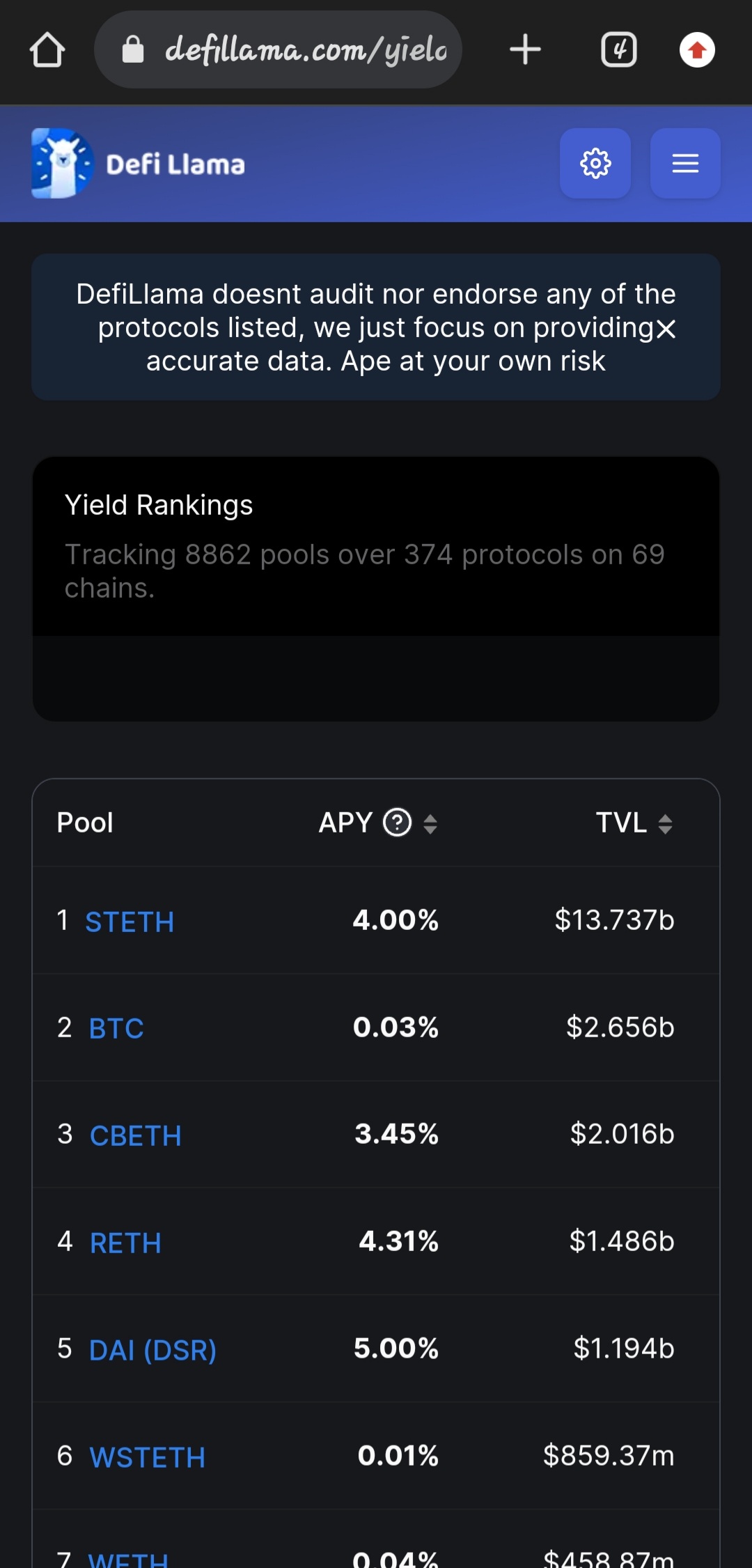

Note: APY and TVL are inversely related; the higher the number of locked assets, the lower the APY.

- A key objective of the Defi Llama project

- Discover new and popular dapps and protocols across blockchains, such as Ethereum, Binance Smart Chain, Polygon, Solana, Avalanche, and more.

- View critical metrics such as total value locked (TVL), market cap, daily volume, fees, users, and transactions for each dapp and protocol.

- Compare dapps and protocols based on their category, such as lending, borrowing, exchange, asset management, derivatives, insurance, etc.

- Analyze the risk and return profiles of different dapps and protocols using various indicators, such as audits, security scores, yield farming opportunities, governance models, etc.

- Monitor the market movements and trends of the defi sector using charts, graphs, and tables.

- Learn more about the defi concepts, terms, and strategies using the educational resources provided by Defi Llama.

Defi Llama dashboard tools

Here is a list of Defi Llama dashboard essential tools:

- DeFi

- Yields

- DEX Meta-aggregator

- Borrow aggregator

- CEX Transparency

- Liquidations

- Volumes

- Fees/Revenue

- Raises

- Stables

- Hacks

- ETH Liquid Staking

Defi is the leading analytics dashboard, that monitors TVL and other data on blockchains and protocols. The section is broken into 11 subcategories for your convenience. It also has an exciting part, the Airdrops section. It also lists protocols that can alert users of token drops.

Yield

Information about pools, protocols, and stablecoins’ APYs is shown in this section. Users can find the most profitable stacking or mining liquidity alternatives here.

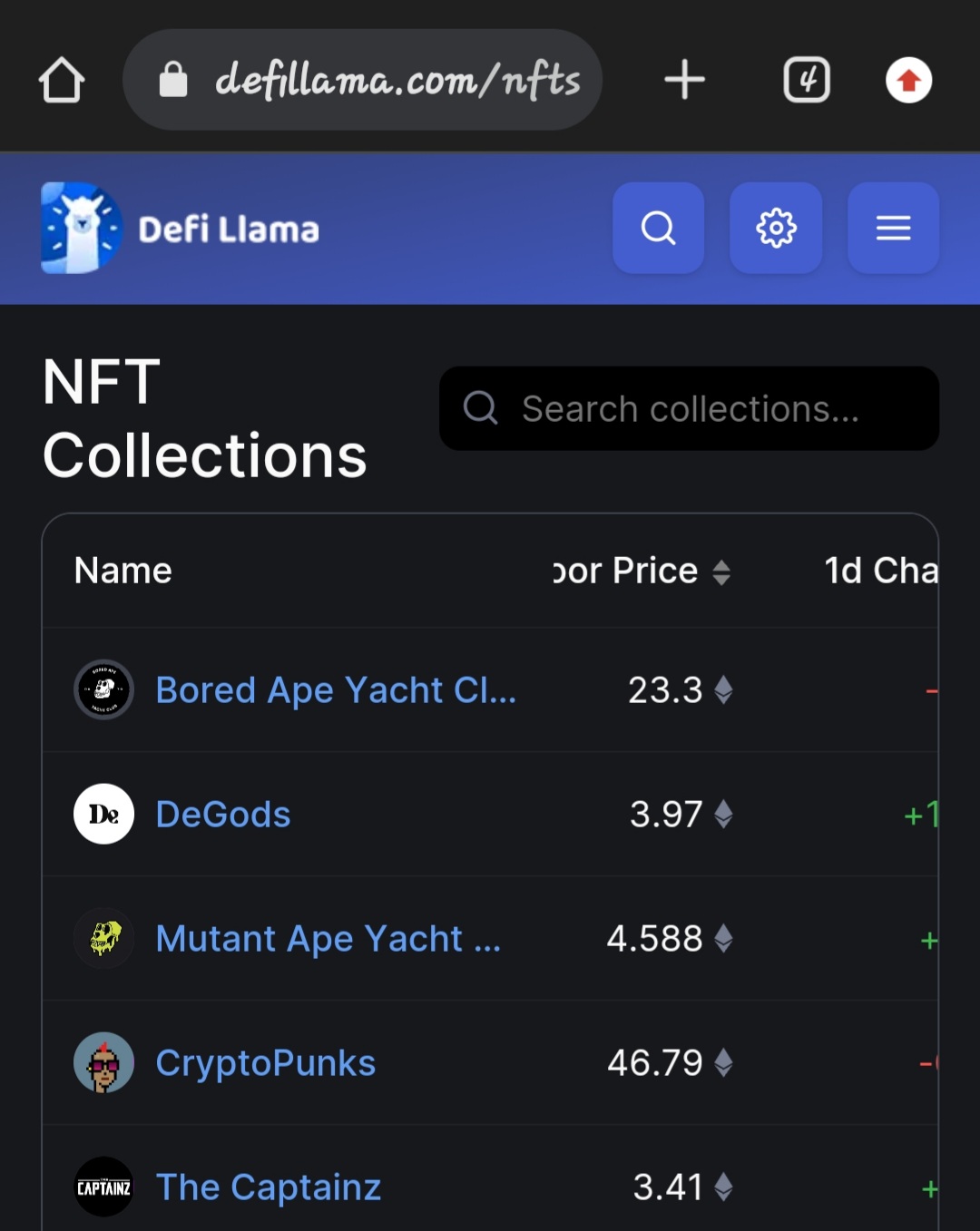

NFT

This section displays NFT collections’ relative floor prices. It also has an area for a list of NFT marketplace and earnings.

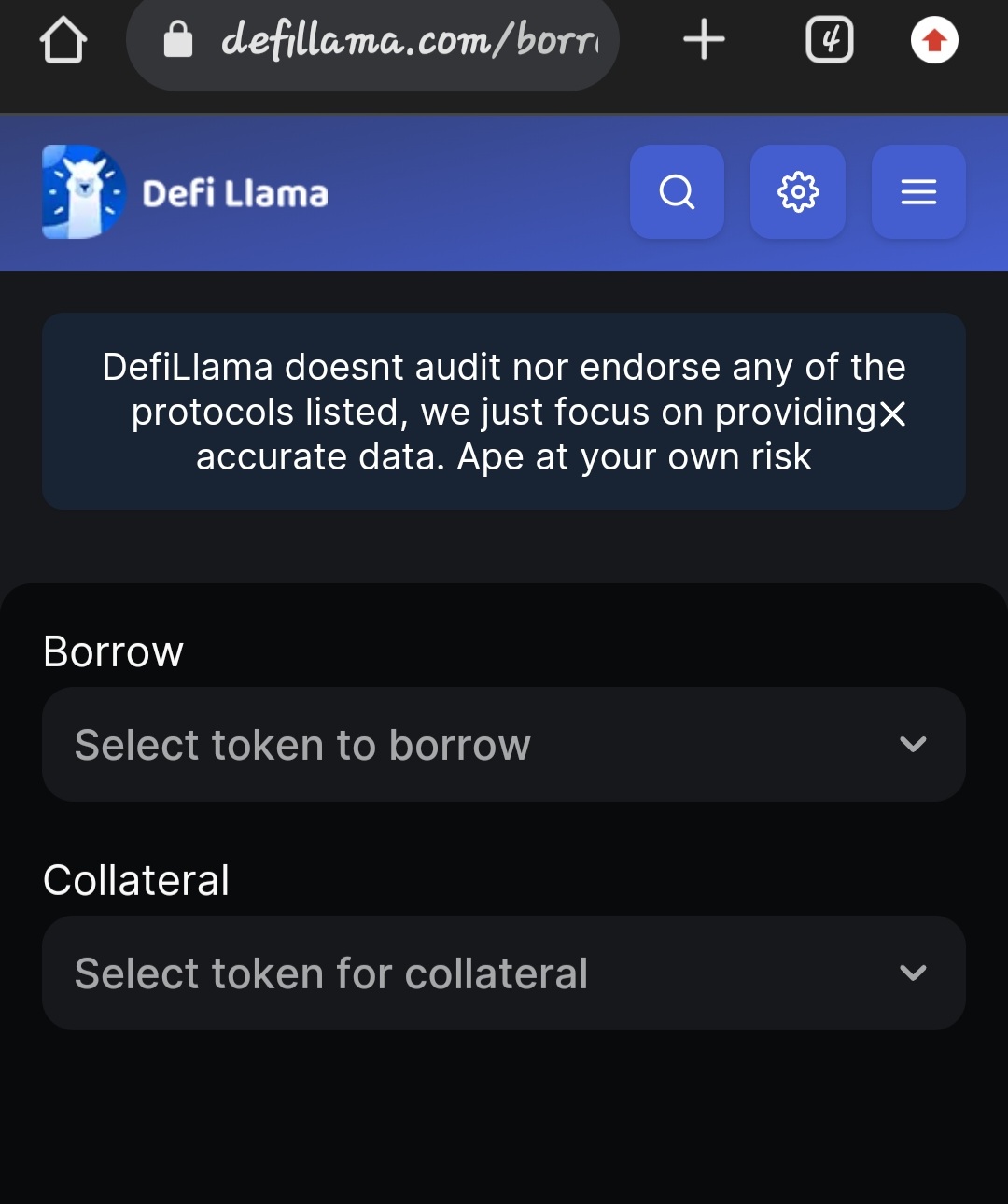

Borrow Aggregator

You will then get a list of acceptable. Then, you will receive a list of proper lending protocols where you can make loans in the most advantageous ways. Most beneficially.

You must decide which coins you wish to receive as a loan and which currencies you want to pledge (CDP).

Dex Meta Aggregator

Meta-aggregator for DEX is an excellent tool for trading/swapping derivatives on well-known blockchains. You must connect your wallet, choose the appropriate network, and decide which tokens to swap before you can complete a swap. Then, enter the amount you want to swap in the ETH equivalent. The Aggregator gathers data from well-known DEXes, and alternatives will be displayed on the right, where it is most profitable to swap the chosen pair.

How to list a Defi project on Defi Llama

The listing procedure differs from the traditional one, which only requires text form submission and team interaction. You will need to perform some technical actions to list on DeFi Llama.

Therefore, to add your project to the platform, you need the following:

- Make a fork of the repository with the adapter

- Make a new folder with your project name in the projects folder.

- Then, you can add an SDK to the folder you made.

- Then, send a Pull Request with changes on your folder.

- The team will add your request after some time, so be patient.

- The front-end developer will upload your project to the website within 24 hours of approval.

If you are inexperienced, the team provides a guide to help you through your journey.

Conclusion.

Defi llama is a data and analytics tool and a community platform for Defi enthusiasts. Users can join the defi llama discord server1 to chat with other users, ask questions, share insights, and get updates from the defi llama team. Users can also contribute to the Defi llama project by submitting feedback, reporting bugs, suggesting features, or adding new dapps and protocols to the platform.

Defi llama is a useful tool for anyone who wants to explore the Defi ecosystem and discover new opportunities. Whether you are a beginner or an expert in defi, defi llama can help you navigate decentralized finance’s complex and dynamic world. You can access DefiLama through its website or its Chrome extension. Happy exploring! 🦙